The PACER PERSPECTIVE

November 2020

“Risk-Free Return” Could Turn Out to Be “Return-Free Risk”

‘May you live in interesting times…’

- Michael Mack, Portfolio Manager

2020 will certainly go down in history as one of the more interesting years we’ve seen. As the Old English phrase alludes to, “may you live in interesting times” might not always be a good thing. This has become increasingly clear in the fixed income market, where record amounts of bonds have been trading at all time low interest rates. Consider the following:

Of the US Fixed Income Universe:

62% yield less than 2% | 25% yield less than 1% | 5% yield more than 5%

Source: Bloomberg US Fixed Income Universe; as of 9/30/20

This incredible lack of yield in the market is forcing investors to reconsider how they invest their fixed income dollars now. In this piece, we will look to highlight why investors own fixed income and how they can adapt to the current environment in an attempt to maintain the diversification benefits of fixed income.

Why Own Fixed Income

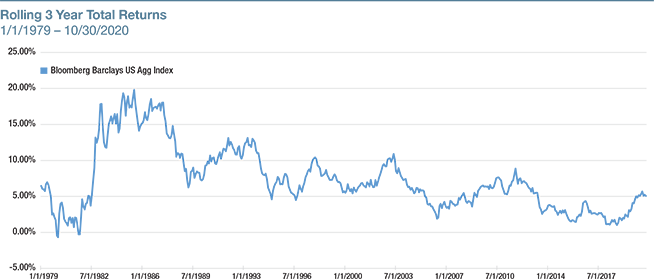

This past decade has seen interest rates fall to record lows, prompting many to call for higher interest rates and lead a rotation out of fixed income and into equities. However, despite these calls, investors have continued to allocate money into fixed income products.

Source: Pacer Advisors, Bloomberg

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU CANNOT INVEST IN AN INDEX

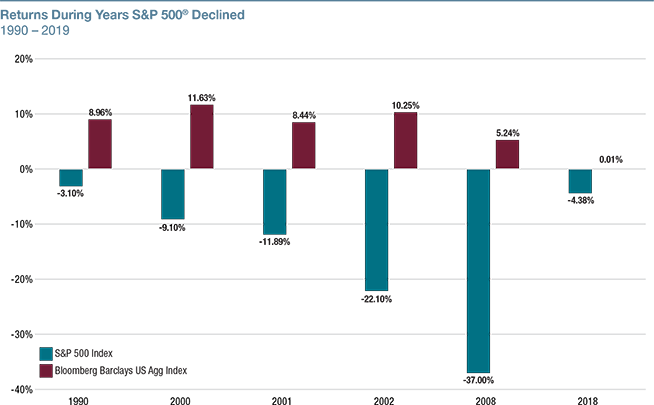

Given the low returns and concerns about rising rates, why have investors continued to allocate to fixed income? The answer to this lies in how bonds have been able to serve as a key diversifier in investor portfolios by generating their best performance when stocks have generated their worst. The chart below shows the performance of Bloomberg Barclays US Agg Index during years where the S&P 500® declined.

Source: Pacer Advisors, Bloomberg

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU CANNOT INVEST IN AN INDEX

In each case, bonds generated a positive return. This meant an investor in a 60/40 portfolio saw 40% of the portfolio appreciate in value. This tendency to generate positive returns during periods of equity market declines explains the resiliency of fixed income flows and underlines the long term need for fixed income to smooth out the volatility that comes with investing in equities.

Looking forward, the outlook for most fixed income returns appears bleak. Though no one knows what the future holds, outlooks suggest fixed income returns have a near one-to-one relation with the current interest rates. Given the near zero interest rates, long-term returns for fixed income could remain low.

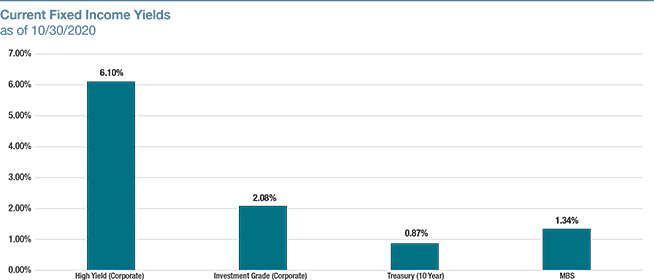

Consider Higher Yielding Possibilities

One option is for investors to shift to other segments of the fixed income markets that may offer higher yields. High yield bonds, for example, offer investors a different way to tap into higher yields with more risk. The chart below shows how high yield bonds offer significant yield pickup versus other fixed income investments.

Source: Bloomberg, based on Bloomberg Fixed Income Universe

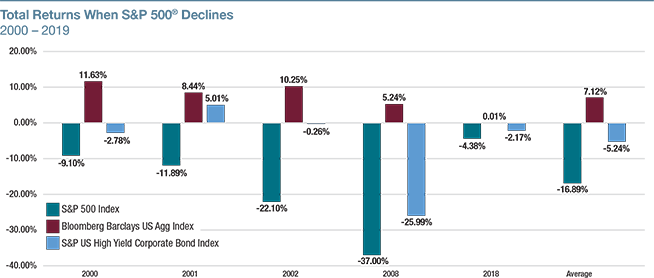

By investing in riskier high yield bonds, investors are compensated with higher yields. Unlike the US Agg Index, high yield bonds tend to decline during periods where the S&P 500® returns are negative.

Source: Pacer Advisors, Bloomberg

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU CANNOT INVEST IN AN INDEX

High yield: Debt securities which bear higher than average credit/default risk compared to other bonds, and compensate investors for bearing this risk with higher yields.

Default/Credit Risk: The risk that a borrower may not be able to pay required interest and/or principal payments on time or in full, per the debt agreement terms.

Investment Grade: A category of higher credit ratings that describes debt instruments with lower default risk and generally lower yields compared to High Yield.

Treasury (10 Year) Yield: The current yield that 10-Year U.S. Treasury Bonds are paying. Treasury bonds are considered one of the safest investments available to investors, and provides a reference point to compare yields in other securities.

MBS: Mortgage-Backed Security: An investment that is made up of a collection of mortgages that vary in risk that are subsequently issued to investors similarly to traditional bonds.

While high yield bonds offer potential for higher yields and higher returns, though this is not guaranteed, they also come with significant downside risk. For example, if an investor is looking to the trend to assess whether or not to invest, the investor will presumably invest if the trend is positive, and reduce or eliminate exposure if the trend is negative. The goal is to provide exposure to generate the positive returns, while reducing the risk by avoiding exposure when the trend is negative. In order for that to work, the investor must find an investment that follows this trend of generating higher returns when the trend is positive and negative returns when the trend is negative. High yield bonds historically tend to fit that profile.

| High Yield Trend vs US Treasuries | Signal | Exposure |

|---|---|---|

| High Yield outperforming | Risk On | High Yield |

| Hig Yield underperforming | Risk Off | US Treasuries |

Source: Pacer Advisors

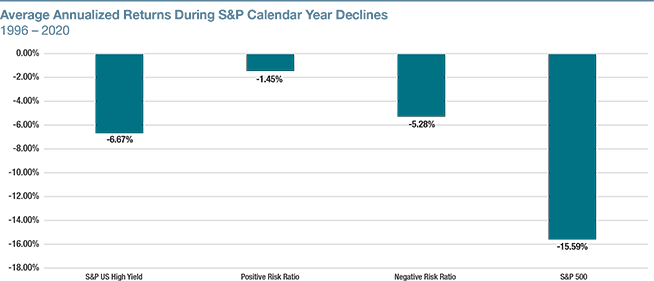

The chart below looks at periods of market decline between 1996 and 2020 and presents the average annual return of the S&P US High Yield Index and the S&P 500 Index during these declines. It also introduces a risk ratio which can be used to asses investor risk appetite in the credit markets. In this case, the risk ratio is designed to measure the relative total return strength of the S&P U.S. High Yield Corporate Bond Index to the S&P U.S. Treasury Bond 7-10 Year Index. We can see below when the trend is positive based on risk ratio, returns are on average down by just -1.45% in times of market decline, whereas the S&P US High Yield is down nearly 7%, and the S&P 500 down more than double that.

Source: Pacer Advisors, Bloomberg

If an investor had avoided high yield exposure during periods when high yield bonds’ relative return trend was negative, They most likely would have missed most of the decline. In addition, investors could possibly then invest that exposure in US treasuries, which have been known to do better during periods of equity market weakness. Putting this all together, we see that a dynamic fixed income strategy may offer the potential to generate higher returns in risk on investment environments through higher yields, while helping to avoid high yield exposure in risk off environments where high yield bonds tend to decline by allocating to US treasuries that may benefit from a flight to safety.

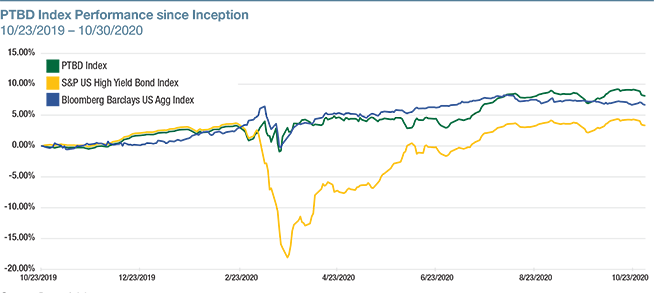

Jumping from theory to action, the recent market decline provides an opportunity to see the trend following strategy in action. The Pacer Trendpilot® US Bond Index (PTBD Index) was in high yield bonds from October 2019 to March 2020. On March 2, a negative trend was established that prompted the PTBD Index to shift exposure from high yield to US Treasuries. By allocating to US Treasuries, the Index was able to miss most of the high yield bond decline. In June of 2020, a positive trend was reestablished, prompting the Index to shift from US Treasuries back into high yield bonds. Over this full cycle, PTBD Index was able to avoid the negative trend while still generating higher returns than the AGG Index.

Source: Pacer Advisors

Pacer ETFs has developed a fixed income strategy that allocates between the S&P U.S. High Yield Corporate Bond Index and the S&P U.S. Treasury Bond 7-10 Year Index through the use of the Pacer Trendpilot® trend following strategy. To determine the trend, the fund uses the 100 Day Simple Moving Average (SMA) of the relative return of high yield bonds versus 7-10 Year US Treasuries. When the relative return is above its 100 Day SMA, the trend is positive. If it is below, the trend is negative and the fund will begin its switch into US Treasuries.

This document does not take into account any investor’s particular investment objectives, strategies, tax status, or investment horizon. Please consult with your financial advisor and tax advisor before investing. This document is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy.

This document represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. The user of this information assumes the entire risk of any use made of the information provided herein. There is no guarantee this strategy will be successful.

Bloomberg Barclays US Agg Index: Broad based, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States.

Download