Before investing you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. This and other information is in the prospectus. A copy may be obtained by visiting www.paceretfs.com or calling 1-877-337-0500. Please read the prospectus carefully before investing.

An investment in the Funds is subject to investment risk, including the possible loss of principal. Pacer ETF shares may be bought and sold on an exchange through a brokerage account. Brokerage commissions and ETF expenses will reduce investment returns. There can be no assurance that an active trading market for ETF shares will be developed or maintained. The risks associated with these funds are detailed in the prospectus and could include factors such as alternator strategy risk, cash redemption risk, data and digital revolution companies risk, high yield risk, industrials and logistics companies risk, management risk, calculation methodology risk, concentration risk, currency exchange rate risk, derivative risk, dividend risk, emerging markets risk, equity market risk, ETF risks, European investments risk, fixed income risk, foreign sales risk, foreign securities risk, future contracts risk, geographic concentration risk, government obligations risk, high portfolio turnover risk, index criteria risk, international operations risk, large and mid-capitalization investing risk, monthly exposure risk, new fund risk, non-diversification risk, other investment companies risk, passive investment risk, real estate companies risk, REIT investment risk, models and data risk, sector risk, sector rotation risk, smaller-capitalization companies risk, style risk, tax risk, tracking risk, trading halt risk, trend lag risk, energy infrastructure industry risk, MLP risk, risk of investing in China, risk of investments in A-Shares, A-Shares tax risk, risk of investing through Shanghai-Hong Kong Stock Connect, risk of investing in Issuers listed on the ChiNext Board, authorized participant concentration risk, concentration risk, costs of buying or selling fund shares, emerging markets risk, equity securities risk, financial sector risk, index tracking error risk, international closed market trading risk, large-capitalization securities risk, market risk, non-U.S. currency risk, non-U.S. securities risk, passive investment risk, risk of cash transactions, secondary market trading risk, shares of the fund may trade at prices other than NAV, cybersecurity risk and/or special risks of exchange traded funds.

The Pacer Trendpilot® US Large Cap Index, Pacer Trendpilot® US Mid Cap Index, Pacer US Small Cap Cash Cows Index, Pacer US Export Leaders Index, Pacer WealthShield Index, Pacer Trendpilot® International Index, Pacer US Cash Cows Growth Index, Pacer Trendpilot® Fund of Funds Index and Pacer Trendpilot® US Bond Index (the “Indices”) are the property of Index Design Group, LLC which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Indices. The Pacer Trendpilot® US Bond Index is based in part on the iBoxx $ Liquid High Yield Index and the iBoxx $ Treasuries 7-10 Year Index. The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices will not be liable for any errors or omissions in calculating the Indices. “Calculated by S&P Dow Jones Indices” and the related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Index Design Group, LLC. S&P® and iBoxx® are registered trademarks of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

The Pacer NASDAQ-100 Trendpilot® Index is co-owned by Index Design Group, LLC. and Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”). The NASDAQ-100 is a registered trademark of the Corporations and is licensed for use by Index Design Group, LLC. The Product(s) are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the product(s).

“FTSE®” is a trade mark of the London Stock Exchange Group companies and is used by FTSE International Limited under license. All rights in the FTSE indices and / or FTSE ratings vest in FTSE and/or its licensors. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE indices and / or FTSE ratings or underlying data and no party may rely on any FTSE indices, ratings and / or data underlying data contained in this communication. No further distribution of FTSE Data is permitted without FTSE’s express written consent. FTSE does not promote, sponsor or endorse the content of this communication.

Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and / or Russell ratings or underlying data and no party may rely on any Russell Indexes and / or Russell ratings and / or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

The Russell 1000 Index (the “Index”) is a trademark of Frank Russell Company (“Russell”) and has been licensed for use by Index Design Group, LLC (“IDG”). The Pacer US Cash Cows 100 Index is not in any way sponsored, endorsed, sold or promoted by Russell or the London Stock Exchange Group companies (“LSEG”) (together the “Licensor Parties”) and none of the Licensor Parties make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to (i) the results to be obtained from the use of the Index (upon which the Pacer US Cash Cows 100 Index is based), (ii) the figure at which the Index is said to stand at any particular time on any particular day or otherwise, or (iii) the suitability of the Index for the purpose to which it is being put in connection with the Pacer US Cash Cows 100 Index. None of the Licensor Parties have provided or will provide any financial or investment advice or recommendation in relation to the Index to IDG or to its clients. The Index is calculated by Russell or its agent. None of the Licensor Parties shall be (a) liable (whether in negligence or otherwise) to any person for any error in the Index or (b) under any obligation to advise any person of any error therein.

On 11/1/2022, the underlying index for the INDS and SRVR ETFs changed to the Solactive GPR Industrial Real Estate Index and Solactive GPR Data & Infrastructure Real Estate Index respectively. Solactive AG (“Solactive”) is the licensor of the Solactive GPR Data & Infrastructure Real Estate Index and the Solactive GPR Industrial Real Estate Index (the “Indices”). The financial instruments that are based on the Indices are not sponsored, endorsed, promoted or sold by Solactive in any way and Solactive makes no express or implied representation, guarantee or assurance with regard to: (a) the advisability in investing in the financial instruments; (b) the quality, accuracy and/or completeness of the Index; and/or (c) the results obtained or to be obtained by any person or entity from the use of the Index. Solactive reserves the right to change the methods of calculation or publication with respect to the Index. Solactive shall not be liable for any damages suffered or incurred as a result of the use (or inability to use) of the Index.

The Pacer Cash Cows Fund of Funds Index, Pacer Data Transmission and Communications Revolution Index and Pacer Global Supply Chain Infrastructure Index are not sponsored, promoted, sold or supported in any other manner by Solactive AG nor does Solactive AG offer any express or implicit guarantee or assurance either with regard to the results of using the Index and/or Index trade mark or the Index Price at any time or in any other respect. The Indexes are calculated and published by Solactive AG. Solactive AG uses its best efforts to ensure that the Indexes are calculated correctly. Irrespective of its obligations towards the Issuer, Solactive AG has no obligation to point out errors in the Indexes to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. Neither publication of the Index by Solactive AG nor the licensing of the Indexes or Indexes trade mark for the purpose of use in connection with the financial instrument constitutes a recommendation by Solactive AG to invest capital in said financial instrument nor does it in any way represent an assurance or opinion of Solactive AG with regard to any investment in this financial instrument.

The Lunt Capital U.S. Large Cap Equity Rotation Index, Lunt Capital U.S. MidCap Multi-Factor Rotation Index, and Lunt Capital U.S. Large Cap Multi-Factor Rotation Index (the “Indices”) are a service mark of Lunt Capital Management, Inc. and have been licensed for use by Pacer Advisors, Inc. The Products are not sponsored, endorsed, sold, or promoted by Lunt Capital Management, Inc. and Lunt Capital Management, Inc. makes no representation regarding the advisability of investing in the Products. The Index is the property of Lunt Capital Management, Inc., which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Indices. The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices will not be liable for any errors or omissions in calculating the Indices. “Calculated by S&P Dow Jones Indices” and the related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Lunt Capital Management, Inc. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

BlueStar Global Online Gambling, Video Gaming and eSports Index and BlueStar Robotics and 3D Printing Index (the “Indexes”) are the exclusive property of MV Index Solutions GmbH, which has contracted with Solactive AG to maintain and calculate the Indexes. Solactive AG uses its best efforts to ensure that the Indexes are calculated correctly. Irrespective of its obligations towards the MV Index Solutions GmbH, Solactive AG has no obligation to point out errors in the Indexes to third parties including but not limited to investors and/or financial intermediaries of the financial instrument. In particular, MVIS is not responsible for the Licensee and/or for Licensee’s legality or suitability and/or for Licensee’s business offerings. Offerings by Licensee, may they be based on the Pacer BlueStar Digital Entertainment ETF and Pacer BlueStar Engineering the Future ETF (“Products”) or not, are not sponsored, endorsed, sold, or promoted by MVIS, Van Eck Associates Corporation or its affiliates (collectively, “VanEck”), and MVIS and VanEck make no representation regarding the advisability of investing in Licensee and/or in Licensee’s business offerings. MVIS, VANECK AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO LICENSEE.

This website should not be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction. Nothing on this website is intended to be investment, tax, financial, or legal advice.

©2021 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

The Morningstar Rating™ for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales loads. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three-year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10- year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

Information for Non-U.S. Investors:

The products and services described on this web site by Pacer ETF’s are intended to be made available only to persons in the United States or as otherwise qualified and permissible under local law. The information on this web site is only for such persons. Nothing on this web site shall be considered a solicitation to buy or an offer to sell a security to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

Although Pacer ETFs obtains certain data from sources that Pacer ETFs considers reliable, all data contained herein is provided “as is”. Pacer ETFs makes no warranty or representation of any kind, express or implied, with respect to the forementioned data, the timeliness, or the results to be obtained by the use thereof or any other matter. Pacer ETFs disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement for a particular purpose.

Our product sector and sub-sector data use the Global Industry Classification Standard (GICS).

Investment products offered are: Not FDIC Insured • No Bank Guarantee • May Lose Value

Trendpilot®, Autopilot ETFs™, Cash Cows Index®, Cash Cows ETFsTMand Strategy Driven ETFs® are trademarks of Index Design Group, LLC., an affiliate of Pacer Advisors, Inc.

Distributor: Pacer Financial, Inc, member FINRA, SIPC, an affiliate of Pacer Advisors, Inc.

© 2015 - 2024 Pacer Financial, Inc. All rights reserved.

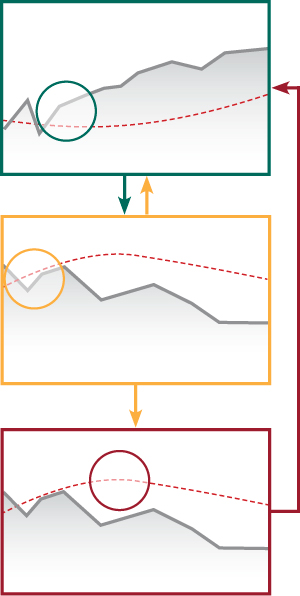

Trendpilot Strategy

Trendpilot Strategy